|

|

|

|

|

|

|

|

|

|

|

|

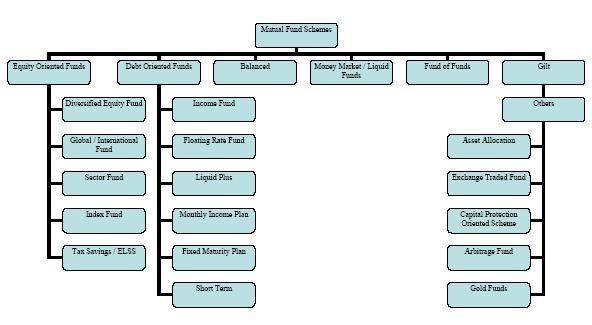

Mutual Fund schemes can be classified into different categories and subcategories

based on their investment objectives or their maturity periods.

|

|

Mutual Fund schemes can be classified into three categories based on their maturity

periods.

|

|

These are mutual fund schemes which offer units for purchase and redemption subscription

on a continuous basis. In other words, the units of these schemes can be purchased

or redeemed at any point of time at Net Asset Value (NAV) based prices. Also, these

schemes do not have a fixed maturity period and an investor can redeem his units

anytime.

|

|

These are mutual fund schemes which have a defined maturity period e.g. 1 year /

5 years etc. The units of close ended scheme can be bought only during a specified

period at the time of initial launch. SEBI stipulates that all close-ended schemes

should provide for a liquidity window to its investors. These schemes are either

required to be listed on a recognized stock exchange or provide periodic repurchase

facility to investors.

|

|

These schemes are a cross between an open-ended and a close-ended structure. These

schemes are open for both purchase and redemption during pre-specified intervals

(viz. monthly, quarterly, annually etc.) at the prevailing NAV based prices. Interval

funds are very similar to close-ended funds, but differ on the following points.

|

|

|

- They are not required to be listed on the stock exchanges,

as they have an in-built redemption window.

- They can make fresh issue of units during the specified

interval period, at the prevailing NAV based prices.

- Maturity period is not defined.

|

|

Apart from the above classification, mutual fund schemes can also be classified

based on their investment objectives:

|

|

|

|

Apart from the above classification, mutual fund schemes can also be classified

based on their investment objectives:

|

|

Growth/ Equity oriented schemes are those schemes which predominantly invest in

equity and equity related instruments. The objective of such schemes is to provide

capital appreciation over the medium to long term. These types of schemes are generally

meant for investors with a long-term outlook and with a higher risk appetite.

|

|

The main objective of debt-oriented funds is to provide regular and steady income

to investors. These schemes mainly invest in fixed income securities such as Bonds,

Money Market Instruments, Corporate Debentures, Government Securities (Gilts) etc.

Debt-oriented schemes are suitable for investors whose main objective is safety

of capital along with modest growth. These funds are not affected because of fluctuations

in equity markets. However, the NAV of such funds is affected because of change

in the interest rate in the country.

|

|

Balanced Funds provide the best of both worlds i.e. equity and debt. The aim of

the balanced funds is to provide both capital appreciation and stability of income

in the long run. The proportion of investment made into equities and fixed income

securities is pre-defined and mentioned in the offer document of the scheme. This

type of scheme is a good alternative for pure equity-oriented products and provides

an effective asset allocation tool. These schemes are suitable for investors looking

for moderate growth. NAVs of such funds are generally less volatile in nature compared

to pure equity funds.

|

|

These Funds invest exclusively in the dated securities issued by the government.

These funds carry a very minimal risk because they are free of any default or credit

risk. However, they do carry an interest rate risk as is the case with other debt

products.

|

|

These are predominantly debt-oriented schemes, whose main objective is preservation

of capital, easy liquidity and moderate income. To achieve this objective, liquid

funds invest predominantly in safer short-term instruments like Commercial Papers,

Certificate of Deposits, Treasury Bills, G-Secs etc..

|

|

|

|

These schemes are used mainly by institutions and individuals to park their surplus

funds for short periods of time. These funds are more or less insulated from changes

in the interest rate in the economy and capture the current yields prevailing in

the market.

|

|

Fund of Funds (FoF) as the name suggests are schemes which invest in other mutual

fund schemes. The concept is popular in markets where there are number of mutual

fund offerings and choosing a suitable scheme according to one’s objective is tough.

Just as a mutual fund scheme invests in a portfolio of securities such as equity,

debt etc, the underlying investments for a FoF is the units of other mutual fund

schemes, either from the same fund family or from other fund houses.

|

|

The term ‘capital protection oriented scheme’ means a mutual fund scheme which is

designated as such and which endeavours to protect the capital invested therein

through suitable orientation of its portfolio structure. The orientation towards

protection of capital originates from the portfolio structure of the scheme and

not from any bank guarantee, insurance cover etc. SEBI stipulations require these

type of schemes to be close-ended in nature, listed on the stock exchange and the

intended portfolio structure would have to be mandatory rated by a credit rating

agency. A typical portfolio structure could be to set aside major portion of the

assets for capital safety and could be invested in highly rated debt instruments.

The remaining portion would be invested in equity or equity related instruments

to provide capital appreciation. Capital Protection Oriented schemes are a recent

entrant in the Indian capital markets and should not be confused with ‘capital guaranteed’

schemes.

|

|

The objective of these funds is to track the performance of Gold. The units represent

the value of gold or gold related instruments held in the scheme. Gold Funds which

are generally in the form of an Exchange Traded Fund (ETF) are listed on the stock

exchange and offers investors an opportunity to participate in the bullion market

without having to take physical delivery of gold.

|

|

A quantitative fund is an investment fund that selects securities based on quantitative

analysis. The managers of such funds build computer based models to determine whether

or not an investment is attractive. In a pure "quant shop" the final decision to

buy or sell is made by the model. However, there is a middle ground where the fund

manager will use human judgment in addition to a quantitative model. The first Quant

based Mutual Fund Scheme in India, Lotus Agile Fund opened for subscription on October

25, 2007.

|

|

With the opening up of the Indian economy, Mutual Funds have been permitted to invest

in foreign securities/ American Depository Receipts (ADRs) / Global Depository Receipts

(GDRs). Some of such schemes are dedicated funds for investment abroad while others

invest partly in foreign securities and partly in domestic securities. While most

such schemes invest in securities across the world there are also schemes which

are country specific in their investment approach.

|

|

Real Estate Mutual Funds or realty funds as they are popularly known are the latest

addition to the mutual fund offerings in India. SEBI recently paved way for the

launch of such products, by making amendments to its existing Regulations. However,

real estate mutual funds are yet to be introduced in India by any asset management

company. These schemes invest in real estate properties and earn income in the form

of rentals, capital appreciation from developed properties. Also some part of the

fund corpus is invested in equity shares or debentures of companies engaged in real

estate assets or developing real estate development projects. REMFs are required

to be close-ended in nature and listed on a stock exchange.

|

|

|

|

In addition to the above broad classification, mutual fund schemes can be further

classified into sub-categories. Each of the sub-categories has a stated objective

and caters to specific requirements of investors.

|

|

Under growth option, dividends are not paid out to the unit holders. Income attributable

to the Unit holders continues to remain invested in the Scheme and is reflected

in the NAV of units under this option. Investors can realize capital appreciation

by way of an increase in NAV of their units by redeeming them.

|

|

Dividends are paid out to the unit holders under this option. However, the NAV of

the units falls to the extent of the dividend paid out and applicable statutory

levies.

|

|

The dividend that accrues on units under option is re-invested back into the scheme

at ex-dividend NAV. Hence investors receive additional units on their investments

in lieu of dividends.

|